Savings FAQ

Here are some of the frequently asked questions about savings here at Killarney Credit Union.

Question: Are my savings secure?

Killarney Credit Union offers treble the protection on your savings.

- Irish Government Protection Scheme up to €100,000 per account

- Irish League of Credit Unions Savings Protection Scheme

- Killarney Credit Union’s own strong Reserve Fund.

Credit Unions in the Republic of Ireland are covered by the Deposit Protection Scheme which is administered by the Central Bank of Ireland. This is a scheme that can provide compensation to depositors if a credit institution is forced to go out of business. It covers deposits held with Banks, Building Societies, and Credit Unions. Please see the Central Bank of Ireland’s website for further information.

In addition to this, the Savings Protection Scheme (SPS) owned and operated by the Irish League of Credit Unions is also available to proactively intervene to protect members’ savings by making available financial assistance to help any Credit Union which may experience difficulties.

Also, members’ savings are insured through Life Savings Insurance (subject to certain terms and conditions).

Question: What is the withdrawal policy of Killarney Credit Union Ltd.?

- Shares and Deposits can be withdrawn on demand provided they are not held as security against a loan.

- Shares and Deposit withdrawals can be made during office hours.

- Please bring photo identification when making a withdrawal.

- There may be limits of withdrawal amounts, if you wish to make a large cash withdrawal, please let us know in advance, so to have the adequate cash ready for collection.

Question: What is the common fund?

As the amount of shares builds up, the common fund of money grows. This is then available for providing loans to members. All members are encouraged to save regularly, even when repaying a loan. This gives the member several direct benefits, and ensures that there are funds for the credit union for use by all members.

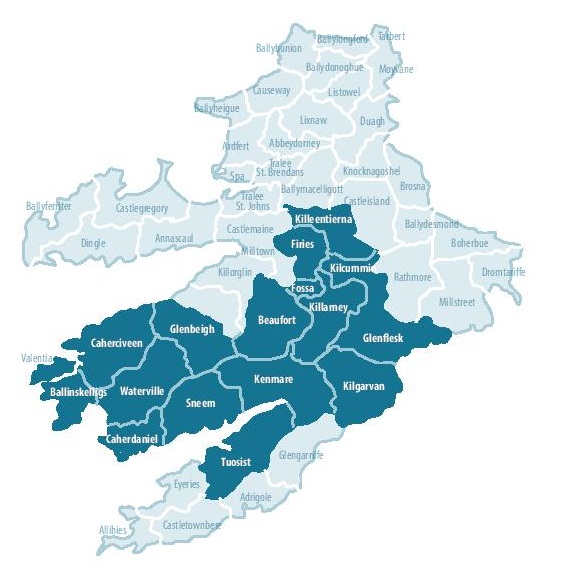

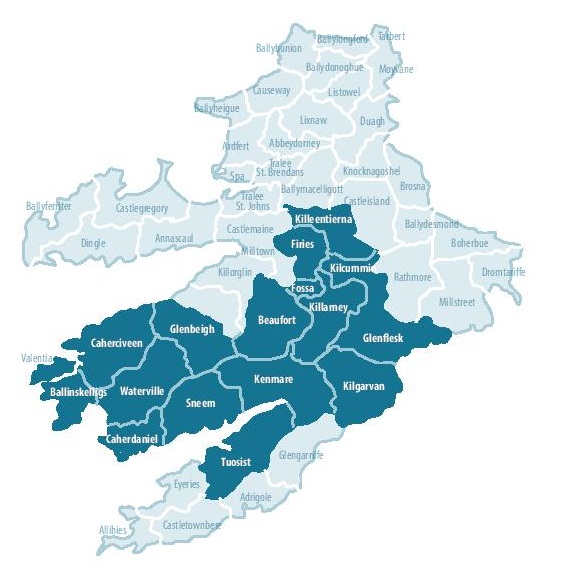

Question: Can I transfer my Credit Union account to Killarney Credit Union?

Provided that you meet the membership criteria of living or working within the common bond area of Killarney Credit Union Ltd you can transfer your savings and keep your savings history. You can also transfer your loan – subject to approval by the Credit Committee and continue to pay the loan balance at Killarney Credit Union Ltd.

Question: Can I withdraw my savings at any time?

Your shares are withdrawable on demand, provided that they are not pledged against a loan. Members are encouraged to keep their savings intact thus ensuring that:

- the Member can maintain credit worthiness and capacity to borrow

- they continue to earn a dividend

- by leaving a balance of €250.00, you benefit from Life Savings Insurance protection

Question: How do I get a statement of my account?

You can request your statement by a personal visit to the office. You have full access to your account by registering for online banking and you can print off estatements as you wish. To register here

Question: What is the savings cap?

Effective since 01.12.2020, members cannot lodge funds above €20,000 in individual accounts held in the credit union.

Question: How do I change my name on my account?

Your name can easily be changed on your account. Just call into the office in person with evidence of your name change e.g. a marriage certificate. Staff will copy the certificate and then complete a change of name

NOTE – Members updating names may also wish to update their form of nomination to take account of their change in circumstances.

Question: How do I change my address on my account?

Your address can easily be changed on your account. Just submit evidence of the change, e.g. a current (within the last 3 months) utility bill or bank statement Staff will copy your documents and then complete a change of address.

Question: How do I close my account?

You may close your account at any time providing there is no loan outstanding on your account. Your photo ID must be presented and any remaining funds withdrawn.

Question: What will happen to my account in the event of my death?

Killarney Credit Union Ltd members complete a form of nomination whereby they can chose where their money will go in the event of their death.

A nomination is a written instruction to the Credit Union as to how to dispose of the contents of a Credit Union account, including insurance benefits, up to a maximum of €23,000, when the holder of the account dies. Any surplus above this figure is passed on to the Members’ estate. It is a legally binding document and is effective regardless of whether a will exists or not. A nomination may be revoked or altered by a subsequent nomination. Marriage invalidates an existing nomination.

Making a nomination is simple: - Visit the office and our staff will guide you through the process easily and without fuss. Once completed and duly witnessed, the Form of Nomination must be lodged in the Credit Union Office. Please Note The nominee or beneficiary is not allowed to witness the nomination. Before the property is transferred to the nominee, proof of death is required. To read more