Managing your account

Read our useful guide on managing and protecting your account

Download guide here

Fast approval

Great rates

Local service

Flexible repayments

Download guide here

Under the Criminal Justice (Money Laundering & Counter Terrorist Financing) Act 2010 to open a standard account in a financial institution including Killarney Credit Union you must have up to date records on file such as:

Membership fee of €0.65 is needed to open the account. €6.35 is required to keep the account activated.

To open an account, please bring all documentation into the branches and staff will be happy to assist you.

To open a joint account, you need to supply items listed above for both parties. Both parties need to be in attendence to open the account jointly. Withdrawal rights on the account will need to be agreed by both parties.

Groups, Clubs and Societies are eligible to join Killarney Credit Union and enjoy all the benefits that credit union membership brings.

A lot of clubs and societies open accounts with us. Some use it for fundraising, others use it for the club’s/society’s administration.

You will need a properly authorised mandate/resolution seeking an application for membership, and giving details of who is authorised / designated to sign on the account being opened.

There has to be a minimum of 2 signatories on these types of accounts.

• Application form for membership to be completed by the authorised /designated signatories with confirmation of signatures for withdrawals to be completed. Copy of the mandate/resolution to be attached to application form. Details of the authorised signatories positions in the Group/Society and their signatures to be completed.

• ID required for each signatory.

• Photo ID (Passport/Drivers Licence) and proof of address (Bank Statement/Utility Bill/Revenue letter dated in past 3 months) required for each signatory.

All members of Killarney Credit Union must recieve the Regulation 53 of the European Communities (Payment Services) Regulations 2009 when the become a member of the credit union. It outlines details of the credit union acccount and payment services contained therein.

In addition, a Depositer Information Leaflet is to be given to members.

If you wish to open an account, please bring all documentation in to any of our branches.

A completed mandate/resolution must be completed for membership, and giving details of who is authorised / designated to sign on the account being opened. Copies of the mandate are available in branch.

The habit of saving is best started early. So if you’re under 16 and would like to start saving or you’re a parent/guardian and would like to start for someone, we have a special option for you.

At Killarney Credit Union we actively encourage children to save. We offer a wide range of saving options for children through schools and in Killarney Credit Union.

Grandparents, parents and guardians can lodge funds to Childrens Accounts but only a parent/guardian can withdraw funds.

If you wish to open an account for your child, please bring all documentation into any of the branches.

All new born accounts opened, get a free €20.00 lodged to their account. So no excuse, not to join today! New born accounts are from 0-2 years of age. Account has to be kept open until the age of 7 years or the €20.00 will be withdrawn from the new born account.

We offer a school savings scheme in a number of schools in South Kerry. These include

These schools are visited regularly by CU staff and accounts are opened by staff and money collected. If you are a school and want a school savings scheme, please contact Karena in Killarney Credit Union.

Click the link below to download the Killarney Credit Union Junior Account Guide as a PDF.

Download the Junior Account Guide as a PDF

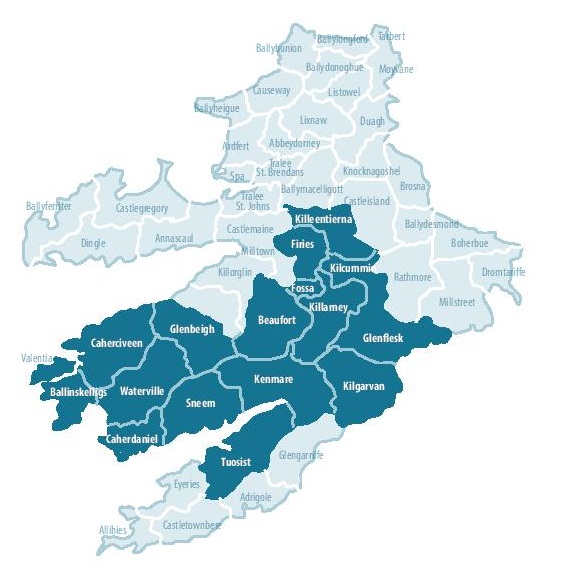

To be eligible for membership of Killarney Credit Union, you need to be working or living in the following areas

Killarney, Fossa, Kilcummin, Glenflesk, Beaufort (Tough), Kilgarvan, Kenmare, Sneem, Killeentierna, Tuosist, and Firies, Glenbeigh, Cahersiveen, Valentia, Ballinskelligs, Waterville, Caherdaniel.

In addition: A person shall be treated as having the qualification required for admission to membership of the credit union if they are a member of the same household as, and is a member of the family of, another person who is a member of the credit union and who has a direct common bond with those other members.

From Home Improvements and Cars to Business Loans and Weddings, we have the perfect loan for you.

Our new Green Loan offers great rates for energy efficient home and transport initiatives. Read more here!

Ready to apply? Our quick enquiry form will get the balling rolling straight away.

Our easy to use loan calculator is here to guide you on loan costs and repayments.